Will Mortgage Rates Go Down in 2025 in Canada?

As Canadian homeowners and prospective buyers continue to navigate a high-interest-rate environment, a key question remains at the forefront: Will mortgage rates decrease in 2025 in Canada? With economic shifts, inflation trends, and the Bank of Canada’s decisions all playing a role, 2025 could bring significant changes to the housing market. In this post, we’ll explore what experts are saying, the factors influencing mortgage rates, and what this could mean for you. Contact us for a mortgage agent near you.

Understanding the Current State of Mortgage Rates

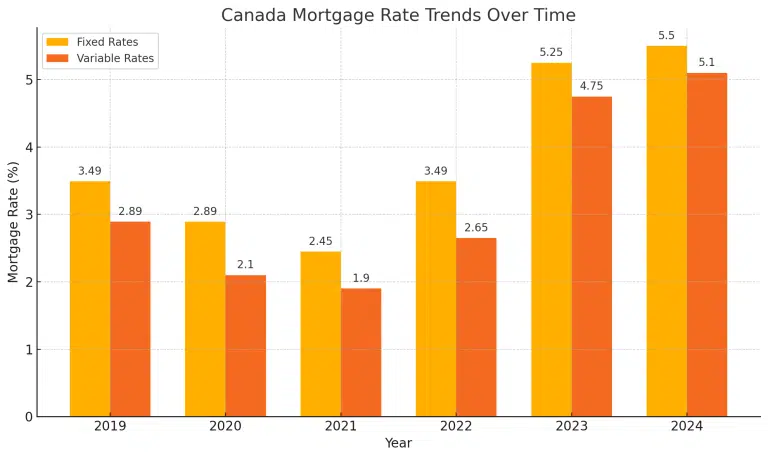

Over the past couple of years, mortgage rates in Canada have remained high due to persistent inflation and the Bank of Canada’s aggressive rate hikes. Fixed-rate mortgages surged past 5% in 2023 and remained relatively high through 2024, creating affordability challenges for many Canadians.

This has led to a slowdown in home sales and refinancing activity, as many homeowners choose to wait for more favourable conditions before making any moves. Contact us for a Mortgage Agent in Woodbridge.

Key Factors That Could Lower Mortgage Rates in 2025

There are several factors that could influence a drop in mortgage rates in 2025:

1. Declining Inflation

If inflation continues to decline toward the Bank of Canada’s target of 2%, the central bank may begin to ease its key interest rate. This would likely result in lower variable mortgage rates and downward pressure on fixed rates.

2. Slower Economic Growth

A weakening economy or signs of recession in 2025 could prompt the Bank of Canada to cut interest rates in an effort to stimulate growth. Lower overnight rates often translate into reduced mortgage rates, making borrowing more affordable.

3. Global Market Conditions

Global economic trends, including U.S. Federal Reserve policy decisions and bond yields, also impact Canadian mortgage rates. If international pressures ease and investors regain confidence, bond yields could fall—leading to lower fixed mortgage rates.

Expert Predictions on Mortgage Rates in 2025

While no one can predict the future with certainty, many economists suggest that we may begin to see gradual reductions in mortgage rates by mid-to-late 2025. The pace and extent of these reductions will depend on inflation, economic performance, and central bank policy.

According to recent forecasts from central Canadian banks and financial institutions, the Bank of Canada may initiate rate cuts as early as the second half of 2025 if inflation continues to trend downward.

What Lower Mortgage Rates Could Mean for You

If mortgage rates decrease in 2025, here’s what you might expect:

Homebuyers: Lower rates could improve affordability, allowing more Canadians to qualify for larger mortgages.

Homeowners: Those with variable-rate mortgages may see lower monthly payments.

Renewals and Refinancing: Borrowers renewing their mortgages may secure better rates than were available in 2023–2024.

While there is cautious optimism that mortgage rates will start to fall in 2025, much depends on how inflation and economic growth unfold in the coming months. Staying informed, working with a trusted mortgage advisor, and regularly reviewing your financial situation will help you make the most of any market changes. Ready to get started? Trust Pash Financial Services for all your mortgage needs.